Middle East and Africa Health Insurance Market – Coverage Expansion, Digital Policy Management & Risk Pool Formalization

"Global Executive Summary Middle East and Africa Health Insurance Market: Size, Share, and Forecast

CAGR Value

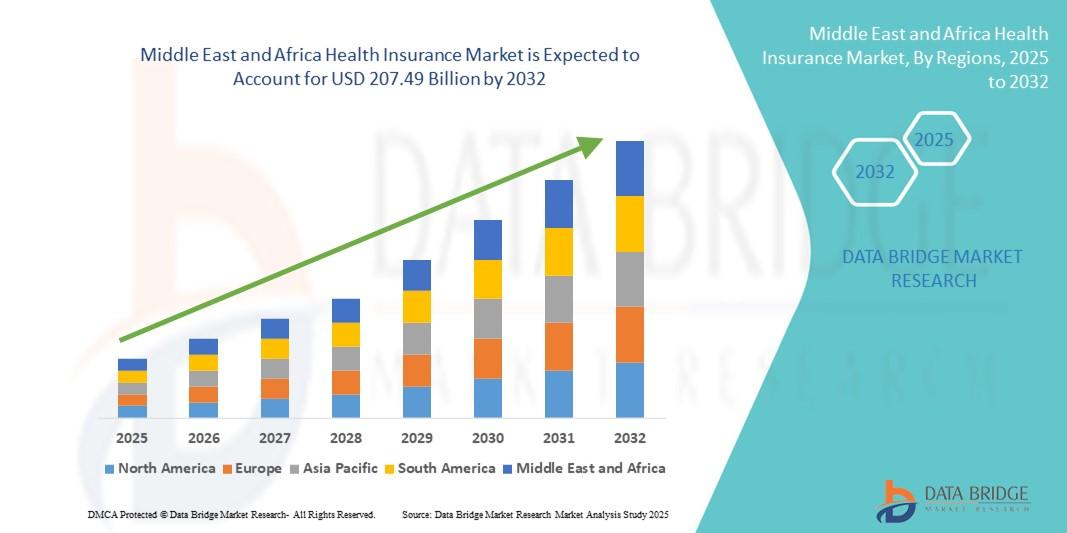

The Middle East and Africa health insurance market size was valued at USD 155.16 billion in 2024 and is expected to reach USD 207.49 billion by 2032, at a CAGR of 3.70% during the forecast period

The complete Middle East and Africa Health Insurance Market report is spread across a number of pages, list of tables & figures, profiling many companies. The major topics of this document can be listed as overview of Middle East and Africa Health Insurance Market industry, Manufacturing cost structure analysis, Development and manufacturing plants analysis, Key figures of major manufacturers, Regional market analysis, Segment market analysis by type and by application, Major manufacturers analysis, Development trend analysis, Marketing channel, and Market dynamics. Market forecast section in the Middle East and Africa Health Insurance Market analysis report is obsessed with production and production value forecasts and key producers forecasts by type, application, and region.

The Middle East and Africa Health Insurance Market analysis report is a skillful and deep analysis of the present situation and challenges. This report focuses on the key drivers, restraints, market opportunities, threats, and risks for major market players. It also makes available analysis of market size, shares, growth, segmentation, revenue projection (USD Mn), and regional study till 2033. The market research document offers a comprehensive overview of the global Middle East and Africa Health Insurance Market and contains thoughtful insights, facts, historical information, and statistically supported and industry-verified market data. It also encompasses forecasts using a suitable set of predictions and distinct research methodologies.

Stay ahead with crucial trends and expert analysis in the latest Middle East and Africa Health Insurance Market report. Download now:

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-health-insurance-market

Middle East and Africa Health Insurance Industry Overview

Segments

- Type: The health insurance market in the Middle East and Africa can be segmented into private health insurance and public health insurance. Private health insurance is typically purchased by individuals or provided by employers as a benefit, while public health insurance is usually funded by the government.

- Service Providers: Another important segment of the market is the type of service providers offering health insurance. This can include traditional insurance companies, healthcare providers offering insurance along with medical services, and even tech companies entering the health insurance space.

- Coverage: Coverage is a crucial aspect of the health insurance market segmentation. It can include segments like individual health insurance, family health insurance, group health insurance for employees, and specialized health insurance for specific medical conditions or treatments.

- Distribution Channel: The distribution channel segment includes how health insurance products are sold and distributed to customers. This can include traditional channels like insurance agents, brokers, as well as digital channels such as online platforms and mobile apps.

Market Players

- AXA: AXA is a leading global insurance company that offers health insurance products in the Middle East and Africa region. They provide a range of health insurance plans catering to different segments of the market.

- Allianz: Allianz is another key player in the health insurance market in the Middle East and Africa. They offer comprehensive health insurance solutions for individuals, families, and businesses.

- MetLife: MetLife is known for its health insurance offerings in the region, providing customers with options for protecting themselves and their families against healthcare expenses.

- Oman Insurance Company: This regional player offers a variety of health insurance products tailored to meet the specific needs of customers in the Middle East and Africa.

- Bupa Arabia: Bupa Arabia is a prominent health insurance provider in the region, offering innovative health insurance solutions and services to individuals and businesses.

The Middle East and Africa health insurance market is diverse and dynamic, with various segments catering to different customer needs. As the region continues to grow economically and technologically, the health insurance market is expected to witness significant growth in the coming years. Market players like AXA, Allianz, MetLife, Oman Insurance Company, and Bupa Arabia are at the forefront, driving innovation and competition in the market.

The Middle East and Africa health insurance market is poised for substantial growth as the region experiences economic development and technological advancement. One key trend that is shaping the market is the increasing adoption of digital channels for the distribution of health insurance products. With the growing penetration of smartphones and internet connectivity in the region, consumers are becoming more inclined towards purchasing health insurance online or through mobile apps. This shift towards digital distribution channels is not only making it more convenient for customers to access insurance products but also enabling insurance providers to reach a wider audience and streamline their operations.

Moreover, the market is witnessing a rise in demand for specialized health insurance products that cater to specific medical conditions or treatments. As healthcare costs continue to escalate, individuals and families are seeking insurance coverage that addresses their unique healthcare needs. This trend is driving insurance companies to innovate and develop tailored insurance solutions that provide comprehensive coverage for specialized treatments, surgeries, or chronic conditions. By offering these specialized health insurance products, insurers are able to differentiate themselves in the market and attract a niche customer base looking for specific coverage options.

Another significant aspect impacting the Middle East and Africa health insurance market is the increasing focus on preventive healthcare. With a growing awareness of the importance of preventive measures in maintaining overall health and well-being, insurance providers are introducing wellness programs and initiatives aimed at promoting healthy lifestyle choices among policyholders. By incentivizing policyholders to engage in preventive healthcare activities such as regular health check-ups, screenings, and fitness programs, insurers are not only reducing the incidence of costly medical treatments but also fostering long-term customer loyalty and satisfaction.

Furthermore, the market is witnessing a surge in partnerships and collaborations between insurance companies and healthcare providers to offer integrated health insurance and medical services. By forming strategic alliances with hospitals, clinics, and healthcare facilities, insurers are able to provide a seamless healthcare experience to policyholders, ensuring access to quality care at affordable rates. These partnerships also enable insurers to manage healthcare costs more effectively and improve the overall health outcomes of their customers.

In conclusion, the Middle East and Africa health insurance market is undergoing significant transformations driven by digitalization, specialization, preventive healthcare, and strategic partnerships. As the region continues to evolve and embrace innovation in the healthcare sector, market players will need to adapt their strategies to meet the changing needs and preferences of consumers. By addressing these emerging trends and challenges, insurers can position themselves for sustained growth and success in the dynamic health insurance landscape of the Middle East and Africa.The health insurance market in the Middle East and Africa is experiencing significant growth and transformation driven by various factors. One key trend shaping the market is the increasing adoption of digital distribution channels for health insurance products. With the rising penetration of smartphones and internet connectivity in the region, consumers are increasingly turning to online platforms and mobile apps to purchase insurance, driving convenience and accessibility. This shift towards digital channels not only benefits customers but also allows insurers to expand their reach and streamline operations, enhancing overall market growth.

Moreover, there is a noticeable rise in demand for specialized health insurance products tailored to specific medical conditions or treatments. As healthcare costs escalate, individuals and families seek insurance coverage that addresses their unique healthcare needs. Insurance companies are responding by developing innovative solutions that offer comprehensive coverage for specialized treatments, surgeries, or chronic conditions. By catering to these specific needs, insurers can differentiate themselves in the market and attract a niche customer base seeking tailored coverage options, thereby driving market growth and competitiveness.

Additionally, preventive healthcare is gaining prominence in the Middle East and Africa, with insurers focusing on promoting healthy lifestyle choices among policyholders through wellness programs and initiatives. By encouraging preventive measures such as regular health check-ups, screenings, and fitness programs, insurers are not only reducing the incidence of costly medical treatments but also fostering customer loyalty and satisfaction. This emphasis on preventive healthcare not only benefits individuals in maintaining their health but also helps insurance companies in managing healthcare costs and improving overall health outcomes, contributing to the market's growth and sustainability.

Furthermore, the market is witnessing increased partnerships and collaborations between insurance companies and healthcare providers to offer integrated health insurance and medical services. By forming strategic alliances with hospitals, clinics, and healthcare facilities, insurers can provide a seamless healthcare experience to policyholders, ensuring access to quality care at affordable rates. These partnerships not only enhance the value proposition for customers but also enable insurers to control healthcare costs more effectively and enhance overall customer satisfaction. In conclusion, the Middle East and Africa health insurance market is evolving rapidly, driven by digitalization, specialization, preventive healthcare, and strategic partnerships, presenting opportunities for market players to adapt and thrive in this dynamic landscape.

Access detailed insights into the company’s market position

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-health-insurance-market/companies

Alternative Research Questions for Global Middle East and Africa Health Insurance Market Analysis

- What is the current valuation of the global Middle East and Africa Health Insurance Market?

- What CAGR is projected for the Middle East and Africa Health Insurance Market over the forecast period?

- What are the key segments analyzed in the Middle East and Africa Health Insurance Market report?

- Which companies dominate the Middle East and Africa Health Insurance Market landscape?

- What geographic data is covered in the Middle East and Africa Health Insurance Market analysis?

- Who are the leading firms operating in the Middle East and Africa Health Insurance Market?

Browse More Reports:

Global Smart City Platforms Market

Global Text to Speech (TTS) Software Market

Global Nanocoatings in Medical Industry Market

Global Malware Analysis Market

Europe Flame Retardant Thermoplastics Market

Global Endotracheal and Tracheal Suction Market

Middle East and Africa Brain MRI Scan Market

Global Aquatic Food Ingredients Market

Global Keratoacanthoma Market

Middle East and Africa Biopesticides Market

Global Skin Closure Devices Market

Global Aesthetic Services Market

North America Intumescent Coatings for Fireproofing and Spray-Applied Fire-Resistive Market

North America Ice Maker Market

Global Plastic Crates Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness